" Best AI Mutual Funds India 2025: Guide to Wealth Creation"

Discover the best AI mutual funds in India for 2025, including top picks like Quant Small Cap Fund and ICICI Prudential Technology Fund. Invest in AI-focused mutual funds for high returns.

Introduction to AI Mutual Funds

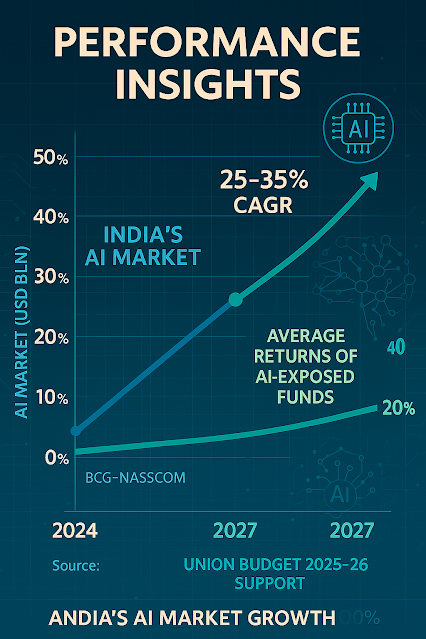

Artificial Intelligence (AI) is reshaping global industries, and India is positioned as a key player in this transformation. The 2025-26 Union Budget earmarks ₹500 crore for AI initiatives, and the AI market in India is projected to grow to $17 billion by 2027 (BCG-NASSCOM). For Indian investors, this is a golden opportunity. By investing in AI mutual funds, which allocate capital to companies adopting AI-driven technologies, you can participate in this boom.These mutual funds don't necessarily focus solely on AI but have significant exposure to companies like TCS, Infosys, NVIDIA, and Tata Elxsi that leverage AI. This article helps you navigate the top mutual funds with strong AI exposure in India for 2025, guiding both new and seasoned investors.

Why Invest in AI Mutual Funds?

AI mutual funds aim to capture the value being created in companies utilizing artificial intelligence, machine learning, automation, and predictive analytics. Here's why you should consider investing:

-

High Growth Potential: AI is expected to add $15.7 trillion to the global economy by 2030.

-

Diversification: These funds spread risk by investing across multiple sectors, adopting AI.

-

Professional Management: Experienced fund managers optimize exposure to AI-heavy stocks.

-

Government Support: India’s National AI Mission and budgetary allocations enhance AI adoption.

Benefits of Investing in AI Technology via Mutual Funds

-

Balanced Innovation & Stability: AI-focused funds often include blue-chip and emerging AI-driven firms.

-

Wealth Creation Potential: Long-term investors have seen significant capital appreciation.

-

Global Exposure: Some funds invest in international tech giants like NVIDIA and Alphabet.

Top AI Mutual Funds in India for 2025

India doesn’t have mutual funds exclusively targeting AI companies. However, several funds offer significant AI exposure through IT, flexi-cap, and global tech funds. Below are the five top performers:

1. ICICI Prudential Technology Fund – Direct Plan

-

Category: Sectoral (Technology)

-

5-Year Return: ~29.1% (Annualized)

-

AI Holdings: TCS, Infosys, HCL Tech

-

Why Choose: Focuses on India’s top IT firms leading in AI R&D

-

Risk Level: High

-

Expense Ratio: ~0.7%

Investment Snapshot:

-

₹10,000 invested 5 years ago = ~₹35,000

2. Parag Parikh Flexi Cap Fund – Direct Plan

-

Category: Flexi Cap

-

5-Year Return: ~23.5%

-

AI Holdings: Alphabet, Meta, TCS

-

Why Choose: Blends Indian and international AI leaders

-

Risk Level: Moderate

-

Expense Ratio: ~0.6%

Investment Snapshot:

-

₹10,000 invested 5 years ago = ~₹28,000

3. Mirae Asset Global X AI & Technology ETF FoF – Direct Growth

-

Category: International Fund of Funds

-

5-Year Return: ~18.5%

-

AI Holdings: NVIDIA, Alphabet, Broadcom

-

Why Choose: Direct global AI exposure

-

Risk Level: High

-

Expense Ratio: ~0.5%

Investment Snapshot:

-

₹10,000 invested 5 years ago = ~₹23,000

4. Tata Digital India Fund – Direct Plan

-

Category: Sectoral (Technology)

-

5-Year Return: ~28.5%

-

AI Holdings: Tata Elxsi, Tech Mahindra

-

Why Choose: Focuses on India's digital transformation

-

Risk Level: High

-

Expense Ratio: ~0.8%

Investment Snapshot:

-

₹10,000 invested 5 years ago = ~₹34,000

5. Quant Small Cap Fund – Direct Growth

-

Category: Small Cap

-

5-Year Return: ~40.19%

-

AI Holdings: Affle India, Saksoft

-

Why Choose: Targets fast-growing AI-focused small caps

-

Risk Level: Very High

-

Expense Ratio: ~0.6%

Investment Snapshot:

Performance Insights & Market Trends

AI-focused funds outperform traditional sectors due to rapid digital transformation and innovation. Notably:-

Quant Small Cap Fund (40.19% p.a.): High-growth AI-based small caps

-

Tata Digital India Fund (28.5% p.a.): AI integration in digital firms

-

ICICI Tech Fund (29.1% p.a.): Focus on tech giants with AI platforms

(Graph Placeholder 1)

Key Companies Fueling AI Mutual Fund Growth

-

TCS: AI tools for banking, retail, and automation

-

Infosys: Nia AI platform

-

NVIDIA: Leading global AI chipmaker

-

Affle India: AI-driven mobile marketing

-

Tata Elxsi: AI in healthcare and automotive

Industry Trends & Government Initiatives

-

National AI Mission: Government initiative to boost AI development

-

Policy Push: ₹500 crore allocated in the 2025 budget for AI

-

AI Start-up Boom: Over 300 Indian start-ups now operate in AI spaces

Risks Involved in AI Mutual Fund Investments

-

Volatility: Especially in small-cap and sectoral funds

-

Currency Risk: For global funds like Mirae Asset

-

Regulatory Uncertainty: Data privacy and AI governance laws

How to Mitigate Risks

-

Diversify across fund categories (small-cap + hybrid)

-

Maintain long-term (5+ year) outlook

-

Review quarterly performance and rebalance the portfolio

How to Start Investing in AI Mutual Funds

-

Choose a Platform: Groww, Zerodha, Paytm Money, Angel One

-

Go for Direct Plans: Lower expense ratio = higher returns

-

Set Up SIPs: Start with as low as ₹500/month

-

Track Fund Performance: Use Value Research, Moneycontrol

-

Understand Taxation: LTCG is taxed at 10% on gains over ₹1 lakh/year

Sample Investment Scenarios

| Fund Name | Return (5-Year CAGR) | Investment Value (₹10,000) |

|---|---|---|

| Quant Small Cap Fund | 40.19% | ₹53,000 |

| ICICI Prudential Technology Fund | 29.1% | ₹35,000 |

| Tata Digital India Fund | 28.5% | ₹34,000 |

| Parag Parikh Flexi Cap Fund | 23.5% | ₹28,000 |

| Mirae Asset Global X ETF FoF | 18.5% | ₹23,000 |

Frequently Asked Questions (FAQs)

1. Are there mutual funds in India that invest only in AI companies?

India does not have pure AI mutual funds, but many funds invest in firms using AI technologies. 2. What is the minimum amount required to start investing?

Most funds allow SIPs from ₹100 and lump-sum investments from ₹1,000.

3. What is the ideal investment duration?

A 5+ year horizon is recommended for best results and to overcome volatility.4. Can conservative investors consider AI funds?

Yes, but allocate a smaller portion to mitigate high-risk exposure. 5. Do AI mutual funds offer global exposure?

Yes, funds like Mirae Asset and Parag Parikh offer international AI stock exposure.

Conclusion

AI is not just a buzzword—it is the future of global business and innovation. Investing in AI mutual funds in India offers an opportunity to align your portfolio with this growth. Whether you choose the aggressive Quant Small Cap Fund or the balanced Parag Parikh Flexi Cap Fund, aligning your investments with AI can be a smart, future-ready strategy.Ensure you do thorough research, diversify, and consult a financial advisor before investing.

.jpeg)

%20and%20ICICI%20Prudential%20Technology%20Fund%20(29.1%25%20p.a.)..png)

,%20ICICI%20Prudential%20Technology%20Fund%20(.png)

,%20Tata%20Digital%20India%20Fund%20(SIP_%20~%E2%82%B94,10.png)

.png)

No comments:

Post a Comment