Zero-Based Budgeting for Beginners: A Step-by-Step Guide

Are you tired of wondering where your money goes each month? Are you living paycheck to paycheck? Do you want to have more control over your money? Zero-based budgeting (ZBB) can help. Every dollar gets a job. This means you decide what each dollar will do. It's about making a plan for your money.

ZBB is a great way to increase your awareness of how you spend, help you control your money better, and even unlock more savings! Let's see how it works.

Step 1: Calculate Your Total Income:

First, you have to know how much money you have. This is your net income. Net income is what you get after taxes and other things are taken out. It covers a specific time, like a month.

List all your money sources. This can be your salary, side work, or investments.

Gather All Income Statements

Finding your total income means looking at all money sources. This might include pay stubs from your job. Or earnings from a side business. Bank statements can show investment income. Don't forget any freelance work income. The main idea is to gather every income statement. This helps you have a clear, full picture.

Calculate Your Net Income

Net income is your take-home pay. Start with your gross income (before taxes). Then, subtract taxes, insurance, and retirement contributions. What's left is your net income. For example, say your gross monthly income is $4,000. Taxes and deductions total $1,000. Your net monthly income is $3,000 ($4,000 - $1,000). This $3,000 is what you'll use for zero-based budgeting.

Step 2: List All Your Expenses

Now, write down everything you spend money on each month. Break these into categories. Some expenses are the same amount each month. Others change.

Differentiate Between Fixed and Variable Expenses

Fixed expenses stay about the same each month. Rent or a car payment is are example. Variable expenses change. Groceries or gas costs are variable. It’s important to know the difference. This is because it helps you plan your budget better. You can easily plan for fixed expenses. Variable ones might need a bit more thought.

Categorize Expenses

Organize your expenses into clear groups. Housing, transportation, food, and entertainment are some ideas. Think about what makes sense for you. Do you spend a lot on eating out? If so, make a specific category for "restaurants." The goal is to see where your money goes. Good categories can give helpful insight.

Step 3: Allocate Funds to Each Expense Category:

This is where the "zero" comes in. You assign every dollar to a job. Add up all your expenses. They should equal your income. If you make $3,000, your expenses should total $3,000. This makes you think about each spending choice.

Prioritize Needs vs. Wants

Needs are things you must have to live. Think of housing, food, and transportation to work. Wants are things you'd like but don't need to survive. Cable TV or eating out are wants. It can be hard to tell them apart sometimes. Ask yourself, "Can I live without this?" If the answer is yes, it’s a want. Knowing this difference is key to managing money.

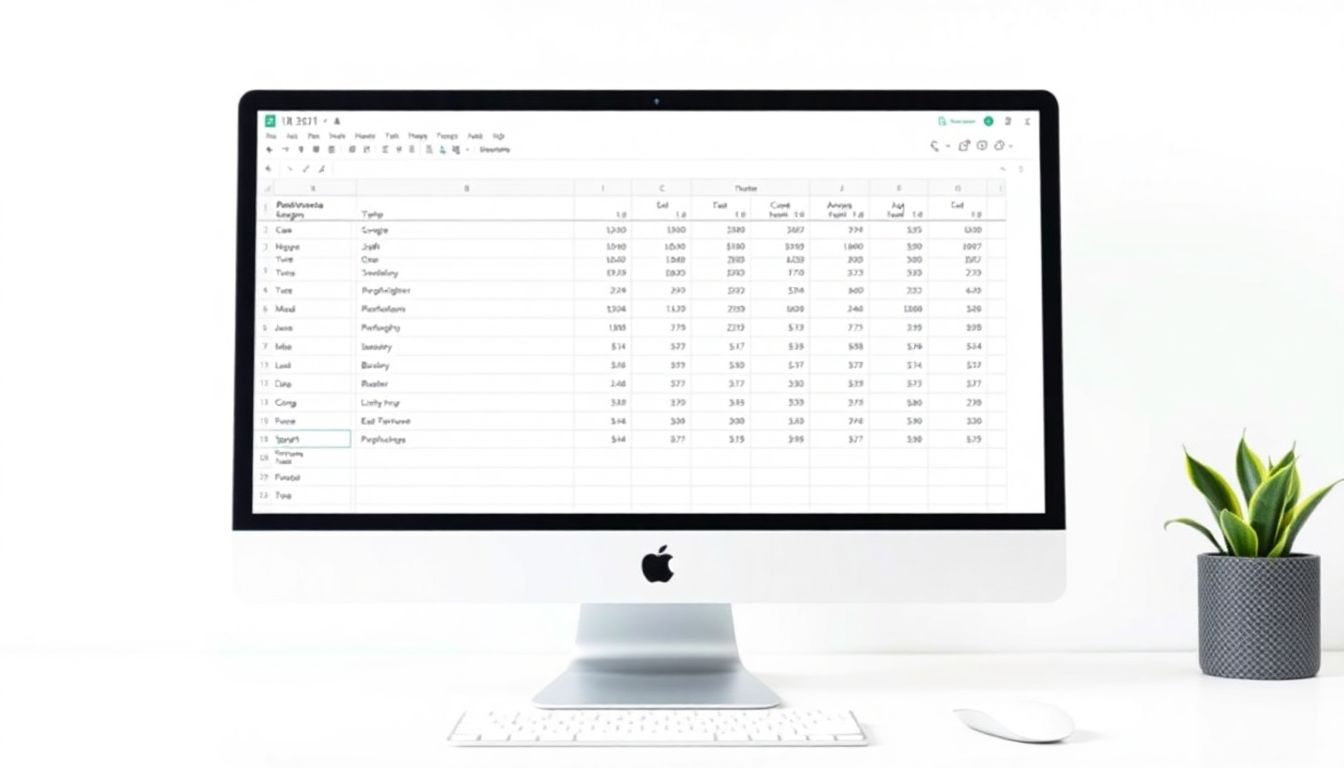

Use Budgeting Tools

Budgeting apps like Mint or YNAB (You Need a Budget) can help. There are also free spreadsheet templates online. Choose a tool that works for you. These tools can make it easier to allocate and track your money.

Step 4: Track Your Spending

Keep track of where your money goes all month. This means comparing what you spend to your budget. Find any spots where you might be spending too much. See where you're spending less, too.

Methods of Tracking

Track your spending in a few different ways. Use a budgeting app to link to your bank accounts. A simple notebook works if you like writing things down. Save receipts to compare against your budget. The right method for you will depend on your needs.

Review and Adjust

Check your budget regularly, like once a week. This lets you make small changes along the way. If you overspent on groceries, cut back on eating out. The point is to stay on track. Regular reviews lead to a more effective budget.

Step 5: Adjust and Optimize Your Budget

At the end of the month, look back at your budget. See what worked and what didn’t. Change your budget for the next month based on what you learn. This keeps your budget in line with your goals.

Identify Areas for Improvement

Look closely at your spending habits. Did you go over budget in certain areas? Were there any unexpected costs? Knowing this helps you plan better. Maybe you need a bigger "fun money" budget. Or, maybe you need to cut back on something. Being honest with yourself leads to a stronger budget.

Set Realistic Goals

Be realistic when setting goals. Don't try to cut all fun spending. Small, achievable goals are easier to stick with. Want to save $100 a month? Great! Write it down. Make sure your goals are specific and measurable. This will improve your chances of meeting your financial goals.

Step 6: Common Pitfalls to Avoid

ZBB is great, but some things can trip you up. Unrealistic budgets and not tracking spending are two. Another is forgetting about surprise costs.

Not Tracking Every Dollar

Every dollar should have a job. It’s easy to lose track of small purchases. Coffee, snacks, and impulse buys add up. Use your tracking method for everything. Even small amounts need tracking. This leads to a more accurate picture of your spending.

Unexpected Expenses

Life happens! The car needs repairs. The water heater breaks. Plan for these costs. Set aside a small amount each month in a "slush fund." This helps you cover surprise costs without ruining your budget. Even a small buffer can bring peace of mind.

Conclusion

Zero-based budgeting gives you power over your money. You start by knowing your income. Then you assign every dollar a job. Track your spending and make changes. You can boost your financial awareness. You'll have more control and reach your goals. Take the first step. Create your budget today!

# think about the process of zero-based budgeting. What might be one drawback of this method be? #zero-based budgeting,# what is zero-based budgeting, #zero-based budgeting advantages and disadvantages.

No comments:

Post a Comment