Personal Finance for Dummies: Navigating the Modern Financial Landscape.

In today's rapidly evolving economic environment, understanding personal finance is more crucial than ever. With the rise of digital platforms and shifting financial trends, individuals must equip themselves with the knowledge to make informed decisions. This guide delves into key aspects of personal finance, incorporating insights from Atlas Personal Finance and the Atlas Personal Finance Club, while highlighting recent developments in economics and personal finance.

The Importance of Financial Literacy.

Financial literacy forms the foundation of sound financial decision-making. It encompasses understanding budgeting, saving, investing, and managing debt. Recent surveys indicate a growing emphasis on improving financial habits. For instance, a study commissioned by Raisin revealed that 65% of Americans aim to enhance their financial practices in 2025. This trend underscores the necessity for accessible financial education resources. Platforms like Atlas Personal Finance offer comprehensive materials tailored for individuals seeking to bolster their financial acumen.New York Post

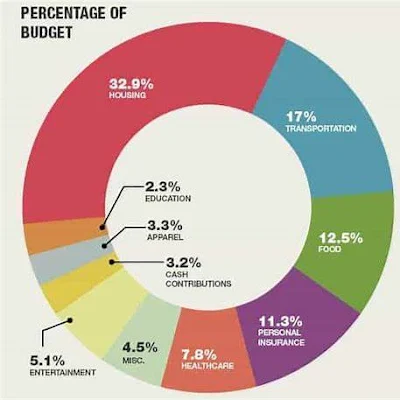

Budgeting: The Cornerstone of Personal Finance

Effective budgeting is pivotal for achieving financial stability. By tracking income and expenses, individuals can identify spending patterns and allocate resources efficiently. The 50/30/20 rule remains a popular budgeting framework:

-

50% for Needs: Essentials such as housing, utilities, and groceries.

-

30% for Wants: Non-essential items like entertainment and dining out.

-

20% for Savings and Debt Repayment: Allocating funds towards savings accounts, investments, and paying off debts.

Adhering to this structure can lead to a balanced financial lifestyle, ensuring that immediate needs are met while preparing for future goals.

The Rise of Digital Banking and FinTech.

The financial landscape has witnessed a significant shift towards digitalization. Digital lending markets, for example, have experienced substantial growth, with projections estimating the market to reach USD 587.27 billion by 2026. This surge is attributed to the convenience and accessibility offered by digital platforms. Atlas Personal Finance Club members have noted the benefits of integrating FinTech solutions into their financial strategies, emphasizing the importance of staying updated with technological advancements.Google News

Investing: Building Wealth Over Time.

Investing is a powerful tool for wealth accumulation. Diversifying investments across various asset classes can mitigate risks and enhance returns. Recent trends highlight the growing interest in decentralized finance (DeFi), offering individuals alternative investment avenues. However, it's essential to conduct thorough research and consult financial advisors before venturing into new investment territories.

Managing Debt: Strategies for Financial Health

Debt management is integral to maintaining financial well-being. With rising credit card debts, individuals must adopt strategies to manage and reduce their liabilities. Implementing debt repayment methods, such as the snowball or avalanche techniques, can provide structured approaches to eliminating debt. Additionally, understanding interest rates and prioritizing high-interest debts can lead to significant savings over time.

Economic Trends Influencing Personal Finance

Staying informed about economic trends is vital for making proactive financial decisions. For instance, the increasing popularity of "public banks" aims to serve minority and underserved communities, potentially impacting personal banking choices. Furthermore, the integration of artificial intelligence in financial planning is set to offer hyper-personalized strategies, revolutionizing how individuals approach their finances.Google NewsYahoo Finance

Utilizing Financial Tools and Resources

Leveraging financial tools can simplify the management of personal finances. Budgeting apps, investment platforms, and financial calculators provide insights into spending habits, investment performance, and future financial projections. Atlas Personal Finance offers a suite of tools designed to assist individuals in navigating their financial journeys effectively.

Community Engagement: Learning from Peers

Engaging with financial communities, such as the Atlas Personal Finance Club, offers opportunities to share experiences, gain insights, and stay motivated. Participating in discussions, attending workshops, and collaborating on financial challenges can enhance one's understanding and commitment to financial goals.

Conclusion:

Navigating the complexities of personal finance requires a combination of education, strategic planning, and adaptability to emerging trends. By prioritizing financial literacy, leveraging modern tools, and engaging with supportive communities, individuals can achieve financial stability and work towards long-term prosperity.

#personal finance for beginners, # how to manage money wisely, # financial literacy for beginners, # money management tips, # how to achieve financial success,.

No comments:

Post a Comment